Insurance practitioners are well acquainted with AM Best and its invaluable financial strength ratings and reports. That same rigor and insight carries over to AM Best's special research products. In November 2024, the research company released its annual "Asbestos & Environmental Reserves Market Segment Report" and in January of this year, it released "2023 US Property/Casualty Impairments Update" — highlighting the ongoing impact of asbestos and environmental losses on insurance companies today.

AM Best has released the asbestos and environmental ("A&E") report nearly every fall for over 20 years (see my blog from last year for a refresher on the terminology I use here). The most recent report examines the A&E loss reserves booked by U.S. insurance companies through December 31, 2023, and the payments they made on those losses. The report also details the top insurance groups with A&E booked liabilities – noting that the top 30 insurers accounted for 97% of loss payments in 2023 and 94% of booked reserves.

It is no surprise to see Berkshire Hathaway at the top of this list given its long-term strategy of using the “float” generated by earning a return on invested premiums before having to pay losses out. Warren Buffet's recent shareholder report reinforced the continuing importance of float to Berkshire's success.

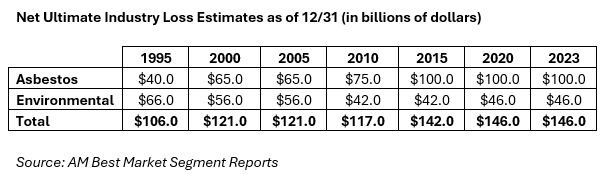

Another datapoint of note is the "ultimate loss estimate" — the estimated total A&E liabilities of US insurance companies for all time, which has grown from $106 billion in 1995 to $146 billion through 2023:

AM Best has not changed these estimates since its year-end 2020 report, despite the emergence of new environmental cleanup concerns like PFAS, microplastics, coal ash, and ethylene oxide, and the proliferation of asbestos-containing talc lawsuits. The report does contains a long discussion on PFAS litigation and coverage issues, so clearly, AM Best is monitoring the emerging losses closely. It will be interesting to see whether the ultimate environmental loss estimate is revised after AM Best analyzes the year-end 2024 filings.

Notably, AM Best estimated that just 33% of A&E liabilities were funded by reserves and payments to date in 1994, but 96% are funded that way today — an encouraging figure that nevertheless implies $5.3 billion(!) in unfunded liabilities. If they can, insurance companies will continue to increase reserves, as needed, to bridge this gap. Despite the concentration of risk, AM Best states that, “[m]ost insurers with material A&E exposures are well capitalized and deemed able to absorb any A&E shortfalls.” The recent failures of Bedivere Insurance Company (2021) and Arrowood Insurance Company (2023) remind us that more insolvencies from A&E liabilities are possible, even though the industry limited or eliminated coverage for these losses decades ago.

Conclusion

We at KCIC like to keep abreast of insurance industry trends that impact our clients; AM Best is one of the best ways to do this. A&E liabilities continue to exert pressure on the balance sheets of insurance companies. A&E payments declined 14% year-over-year but still totaled $2.1 billion in 2023 ($1.6 billion in asbestos payments and $500 million in environmental). Look for more analysis in this space when AM Best releases the 2024 reserves analysis and other interesting reports.

Never miss a post. Get Risky Business tips and insights delivered right to your inbox.

Nick Sochurek has extensive experience in leading complex insurance policy reviews and analysis for a variety of corporate policyholders using relational database technology.

Learn More About Nicholas